The Investment Potential of Developing Corridors: Where Gurukrupa Group Sees the Future

Introduction: Beyond the Present Skyline

In the high-stakes world of metropolitan real estate, the shrewdest buyers look beyond the current infrastructure and focus on the next big growth corridor. Cities like Mumbai and Navi Mumbai are constantly evolving, driven by massive government-led projects and strategic infrastructure development. Investing in these developing corridors is not just about finding an affordable home, it’s about positioning an asset for maximum appreciation and capitalizing on the future expansion of the urban sprawl.

For over 16 years, the Gurukrupa Group has demonstrated an acute understanding of this dynamic, consistently identifying and developing properties in areas poised for exponential growth. Let's explore the investment logic behind focusing on developing corridors and highlight the strategic advantages that a forward-thinking developer brings to an investor’s portfolio.

1. Decoding the Growth Corridor Phenomenon

A "developing corridor" is a geographical stretch of a city that is undergoing rapid transformation, typically triggered by external factors that make the area more accessible and habitable. This is where future demand meets current potential.

A. The Infrastructure Catalyst

The single biggest driver of value in any developing corridor is infrastructure. The moment an area receives improved connectivity

be it a new Metro line, a coastal road, or an elevated highway—the real estate values in that region are virtually guaranteed to rise.

Example of Strategic Positioning: The Gurukrupa Group’s presence in certain micro-markets is often a direct result of anticipating these infrastructural shifts. For example, areas along the proposed expansion routes or those gaining better connectivity to commercial hubs like BKC (Bandra-Kurla Complex) (where projects like Gurukrupa Nirmalam are strategically located) demonstrate a high growth trajectory. Industry consensus holds that location is the primary asset, and the structure is the amenity built upon it.

B. The Demand-Supply Imbalance

Developing corridors often offer a crucial window where property prices are still relatively lower than established central business districts, but the future demand is guaranteed. This brief period is the sweet spot for maximum investment returns before prices normalize with the enhanced connectivity.

2. The Gurukrupa Group Investment Philosophy: Anticipating Tomorrow’s Hotspots

Choosing where to invest requires deep local knowledge and a long-term vision traits that define the Gurukrupa Group’s approach to property development and acquisition.

A. Identifying Connectivity Hotspots

The developer's strategy dictates that growth follows accessibility. They are known to meticulously research upcoming projects, focusing on:

- Transit Proximity: Ensuring projects are mere minutes away from key interchange points, such as developments near major expressways (like Gurukrupa Darshanam in Vikhroli).

- Social Infrastructure: Assessing planned schools, hospitals, and entertainment zones. A truly smart investment offers a complete lifestyle ecosystem, not just four walls.

By building in these high-potential zones, developers like Gurukrupa Group ensure that their customers benefit from early-mover advantages in terms of pricing, without compromising on the quality of construction and amenities.

B. Future-Proofing the Asset

Investing in developing corridors can sometimes carry a degree of perceived uncertainty. This is where a trusted developer becomes the greatest safeguard. Gurukrupa Group future-proofs their developments by:

- Quality Construction: Utilizing advanced technology, like MIVAN construction, which ensures structural longevity and superior finish, making the property desirable even years down the line.

- Legal Transparency: Ensuring all projects are RERA compliant and possess clear titles, shielding the buyer from potential legal hurdles that can sometimes plague developing regions.

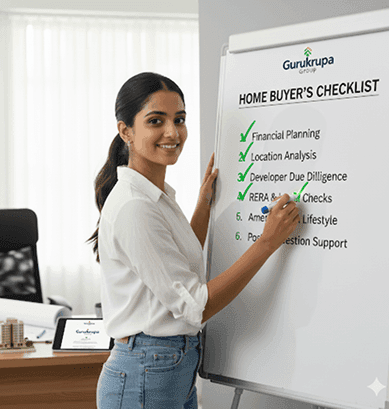

3. The Investor's Checklist for High-Growth Corridors

An investor’s due diligence must be intensified when looking at developing areas. Following these steps helps maximize investment potential:

A. Verify Infrastructure Commitments

Buyers should not rely solely on developer promises. It is crucial to verify local municipal or state government announcements regarding infrastructure projects in the area. Looking for official timelines and budget allocations for roads, water supply, and drainage systems is the difference between speculation and informed investment.

B. Assess the Developer’s Commitment to Timelines

In developing zones, project delays are unfortunately common. This is why the developer's track record is paramount. The Gurukrupa Group’s commitment to its delivery speed is a crucial factor that safeguards the buyer’s financial planning and rental income projections. A delay is a direct cost to the investor.

C. Understand Lifestyle Amenities vs. Essential Services

While a recreational deck is attractive, buyers must ensure the essentials are either already present or definitively planned. Services like robust electricity, reliable water supply, and functional sewage treatment are non-negotiable for comfortable metropolitan living.

Conclusion: Secure Your Future with Strategic Investment

Investing in a developing corridor requires vision, patience, and a reliable partner. It offers the unparalleled opportunity to multiply an investment as the surrounding area matures into a thriving urban hub. By focusing on areas with guaranteed connectivity upgrades and partnering with a developer known for integrity and quality, investors secure a home that delivers both a premium lifestyle and exceptional returns.

Before committing to any metropolitan real estate investment, it is crucial to understand the fundamental steps involved in property selection, legal checks, and financial planning. To ensure all bases are covered and the purchase is stress-free, readers are encouraged to revisit our guide on the essential steps for a property journey.

For deeper insights into the quality construction methods and the zero-wastage planning that future-proofs an investment in these corridors, explore how industry leaders are leveraging technology to deliver excellence.

Choose a location wisely, choose a partner well, and watch the investment grow with the city.

Recent Blogs